Factory closures, plummeting sales, industry-wide layoffs — these are just a few of the effects the COVID-19 pandemic had on the automotive industry.

As industries worldwide begin to find their bearings after two years of starts and stops due to new variants and waves of cases, manufacturers still face major disruptions that existed before the pandemic. Electric vehicles, driverless cars, automated factories and ridesharing are just a few of the changes that automotive companies will continue to face going into the future.

Automotive players — including OEM suppliers, car manufacturers and automotive retailers — are wondering what the future of automotive manufacturing looks like. This blog post will give you insights into shifting efforts online, identifying recurring revenue streams, developing partnerships, optimizing the supply chain and embracing changing consumer demands.

1. Focus On Online Markets and Digitization

One of the lasting effects of the pandemic will be a stronger reliance on technology and online modes of connecting and performing business. Digital channels jumped across all industries at the start of the pandemic, and they will only continue to grow.

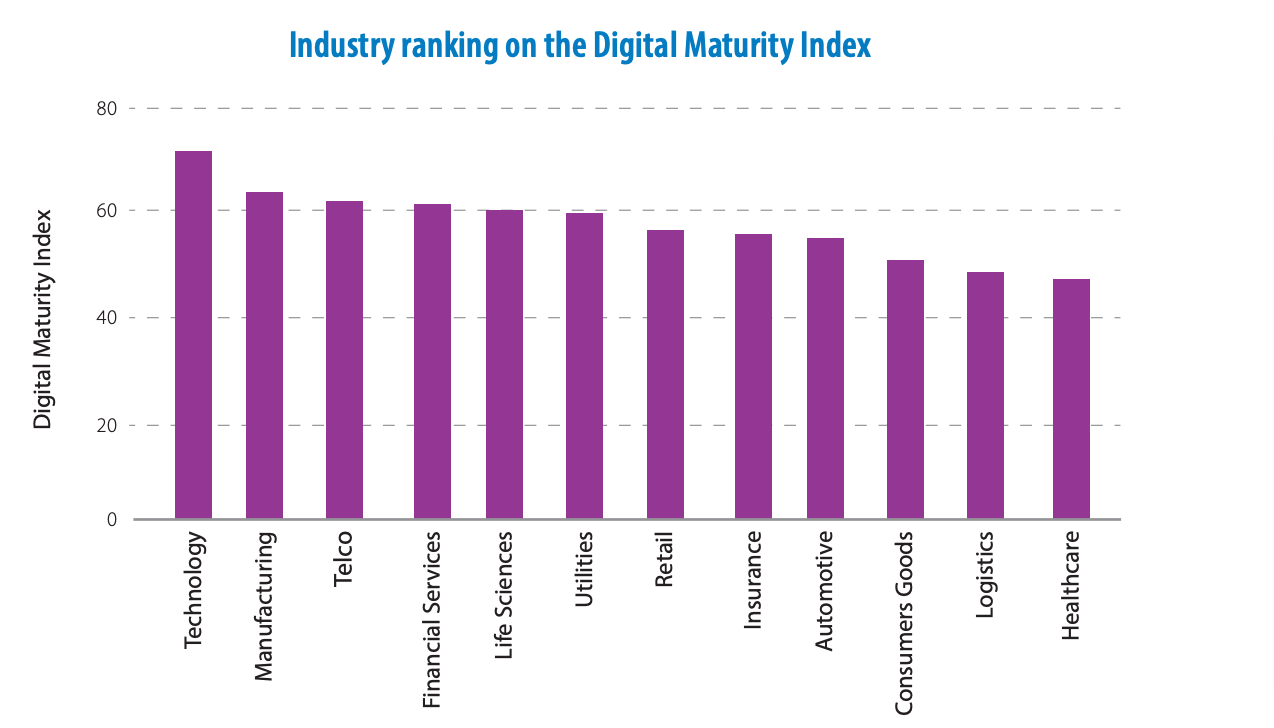

Historically, this has been an issue in the automotive industry. A 2019 report from Infosys showed the automotive industry falling behind on digital trends compared to other industries.

Like many other industries, remote selling models have become necessary. It seems clear that this isn’t going away, with some experts predicting that 80 percent of B2B sales will be conducted digitally by 2025.

Bottom line: Automotive companies need to be able to sell and interact with customers in a digital environment.

2. Identify and Emphasize Recurring Revenue

In 2020, global automotive sales dropped by 8.5 percent compared to the previous year. Although the same research shows an increase in automotive sales in 2021, the number is still below 2019 and projected numbers.

In times of economic uncertainty, consumers tend to avoid larger purchases. However, trends have shown that short-term, subscription-based mobility options — such as rideshares and public transportation — are popular among younger consumers. According to a recent study on generational travel patterns, millennials drive less than previous generations.

To anticipate lost revenue from automotive sales, automotive companies can make more of an effort to invest in:

-

On-demand mobility: Automotive companies need to create more flexibility in their offerings. For example, car rental companies have shortened lease times to accommodate consumers who do not want to invest in vehicle ownership.

-

Automotive technologies: Vehicle software updates and over-the-air updates have significant projected market values over the next several decades. These subscription services allow vehicle owners to pay for updates to unlock new vehicle capabilities.

3. Develop Lasting Partnerships

Rather than competition, the future calls for collaboration between automotive players. The right partnerships can save time and money through procurement strategies, supply chain management and technology.

Even before the pandemic, OEM suppliers and manufacturers engaged in technology investments to future-proof their businesses. Automotive companies that have been around for more than half a century are now facing off against inventive tech players with electric and autonomous vehicles.

Staying ahead of — or at least in line with — tech innovators requires collaboration with former competitors, tech companies and tech-friendly investors.

4. Diversify Supply Chains

The fragility of the global supply chain became clear as day as the pandemic progressed. Reliance on single-country sources is now known to be a problematic solution, so many automotive companies have made supply chain resilience a primary objective.

Currently, China accounts for 35 percent global manufacturing output. Factory shutdowns, country-wide quarantines, logistics issues and other factors contributed to a clear indication that reliance on China is no longer sustainable.

Instead, manufacturers and OEM suppliers have sought out supplier diversification strategies by partnering with up-and-coming manufacturing companies in Southeast Asia.

5. Embrace Changing Demands

Future-proofing needs to be top of mind for every decision maker in every branch of the automotive industry. Disruptors in the industry are responding to the demands of younger generations who are more in favor of electric vehicles than older generations.

This requires adjustments for automotive companies that have modeled their businesses based on outmoded demands.

Automotive players can anticipate making adjustments to accommodate:

-

The rapidly increasing electric vehicle market.

-

The reality of self-driving cars.

-

The technology required for vehicle-to-vehicle communication, artificial intelligence and augmentation.

Enter the Future of Automotive Manufacturing with VPIC Group

No one can predict the future, but by following research, trends and customer demands, you can better anticipate outcomes.

By partnering with VPIC Group as your OEM supplier, you get more than just precision component manufacturing — you also have access to professionals who provide risk management strategies, utilize new technologies and dedicate their working lives to excellence. To learn more about the future of automotive manufacturing, component manufacturing processes, procurement strategies and more, subscribe to our blog today.